Learn how to Get A Startup Business Loan In 5 Steps

페이지 정보

작성자 Nannette Mcvay 댓글 0건 조회 111회 작성일 25-03-08 20:22본문

Small business lenders consider a variety of factors when contemplating a enterprise loan software, including your credit score rating, collateral, income, time in enterprise, business plan, expertise in the industry and more. What If I’m Rejected for a Startup Enterprise Loan? If you’re rejected for a startup enterprise loan, there are various things you are able to do to fund your new enterprise. Step 3: Gather Documents - Prepare the required paperwork equivalent to identification proof, tackle proof, earnings proof and every other paperwork required by the lender. Step four: Calculate Loan Quantity - Decide the loan amount you need and guarantee it aligns together with your financial situation and repayment functionality. Step 5: Visit Lender's Web site - Go to the web site of the chosen lender. Consultant example: If you happen to borrow £10,000 over 3 years at a Representative APR of 5.9% and an annual interest rate of 5.9% fixed, you'll make 36 month-to-month repayments of £303.07. The whole amount payable is £10,910.Fifty two. Be updated with any TSB debts. You must have a great credit score.

If you want to receive lower rates or don’t qualify for a loan in any other case, you will get a secured private loan by placing down helpful collateral, similar to a car. Personal loans with this lender can be used toward debt consolidation, home initiatives, main purchases or life events, like recreation or purchasing autos. You should still have the ability to get a COE when you have been discharged for 1 of the explanations listed right here. What should I do if I received an apart from honorable, dangerous conduct, or dishonorable discharge? If you’ve obtained an aside from honorable, unhealthy conduct, or dishonorable discharge, you is probably not eligible for VA advantages.

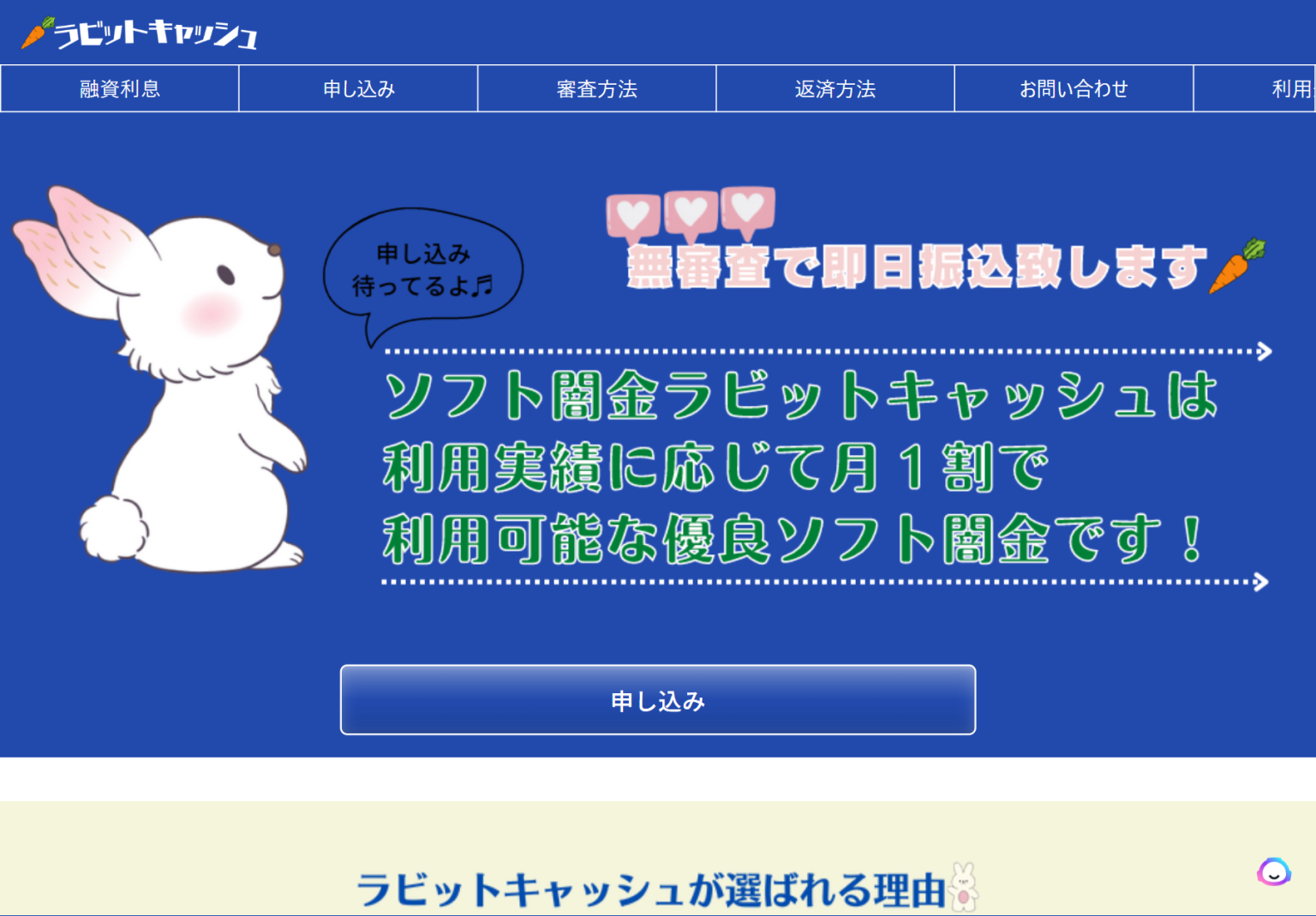

Appearing as a supplier of loans is one of the principle activities of financial institutions resembling banks and bank card firms. For other establishments, issuing of debt contracts similar to bonds is a typical source of funding. A secured loan is a type of debt wherein the borrower pledges some asset (i.e., a automobile, a house) as collateral. A mortgage loan is a quite common sort of loan, used by many people to buy residential or industrial property. In this scenario, lenders charge larger curiosity rates to compensate for the weaker purchasing energy they’ll have from the money that borrowers pay them. Since curiosity rates fluctuate with market situations, ソフト闇金の即日融資ならバルーンがおすすめ the typical curiosity price at one point in time will seemingly differ from the average rate at one other time. The lender’s charges are decided by components similar to an applicant’s credit score, annual earnings, education and job historical past. Prequalification out there — When you apply for prequalification, Upstart makes use of a mushy credit inquiry, which doesn’t have an effect on your credit scores, to offer estimated loan quantities and phrases you may qualify for. But prequalification doesn’t guarantee approval.